In today's ever-evolving housing market, the age-old debate between buying and renting continues to challenge potential homeowners. While both options have their merits, recent data increasingly supports homeownership as a financially sound decision for many Americans. This article examines the current landscape of buying versus renting, highlighting why purchasing a home often represents the better long-term strategy.

Building Equity: The Hidden Advantage

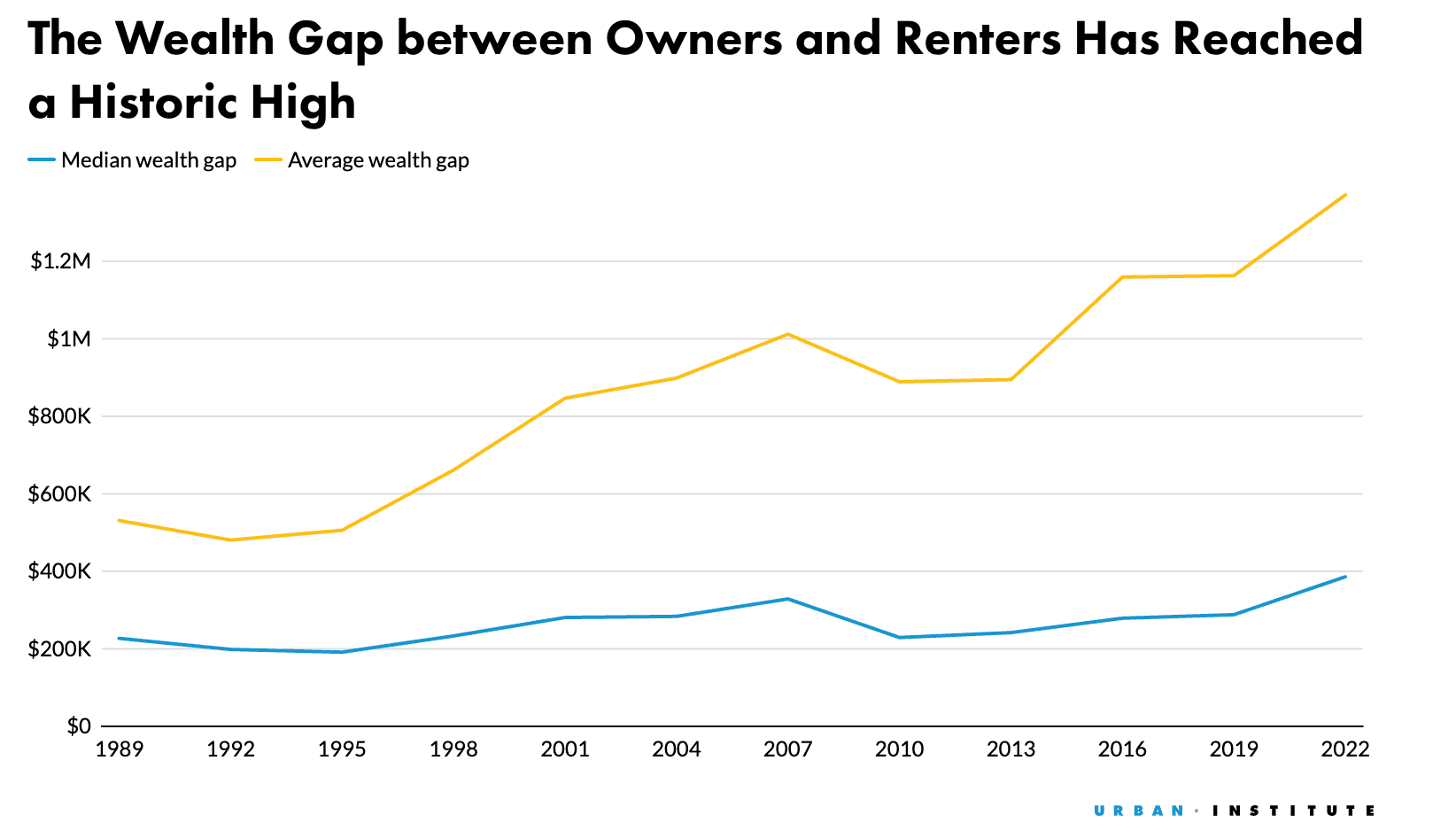

Perhaps the most compelling argument for buying over renting is equity building. When you make mortgage payments, you're gradually acquiring ownership in a tangible asset. According to the Federal Reserve's Survey of Consumer Finances, the median net worth of homeowners is approximately $255,000, while the median net worth of renters is just $6,300—a difference of over 40 times.

This stark contrast exists largely because homeowners build equity with each mortgage payment, while rent payments build no long-term value for the tenant.

Historical Appreciation Trends

Despite market fluctuations, real estate has proven to be a reliable long-term investment. The National Association of Realtors reports that median home prices have increased at an average annual rate of approximately 4% over the past 50 years, outpacing inflation in most decades.

Even accounting for the 2008 housing crisis, homeowners who held their properties for 10+ years typically saw significant appreciation. Recent data from S&P CoreLogic Case-Shiller Home Price Index shows home values have increased by over 40% in the past five years alone in many metropolitan areas.

Tax Advantages of Homeownership

The tax benefits of owning a home remain substantial despite recent tax law changes. Homeowners can deduct mortgage interest on loans up to $750,000 and property taxes up to $10,000. According to the Tax Policy Center, these deductions save the average homeowner approximately $2,000 annually, benefits unavailable to renters.

Furthermore, when selling a primary residence after 2 years of residing, individuals can exclude up to $250,000 of capital gains from taxation ($500,000 for married couples filing jointly), a significant advantage for long-term homeowners.

Rent vs. Mortgage Payment Comparison

While high interest rates have impacted affordability, many markets still favor buying over renting when considering total lifetime costs. ATTOM Data Solutions' 2023 Rental Affordability Report found that in 58% of U.S. counties, owning a median-priced home is more affordable than renting a three-bedroom property.

Even with higher initial monthly payments in some cases, the fixed nature of most mortgage payments provides stability against rent increases. According to Apartment List, national median rents have increased by approximately 15% over the past three years, while fixed-rate mortgage payments remain constant.

Long-Term Cost Analysis

A study by the Urban Institute projected that individuals buying a home today and living in it for at least 7 years would build more wealth than renters in most scenarios, even accounting for maintenance costs and market fluctuations.

Their analysis showed that after 30 years, the average homeowner would have approximately $130,000 more in net worth than renters who invested the difference between their rent and the equivalent homeownership costs.

Stability and Community

Homeownership provides intangible benefits that extend beyond financial considerations. Research from the National Association of Realtors indicates that homeowners typically stay in their homes for an average of 13 years, compared to renters who move every 2-3 years.

This stability translates to stronger community ties, better educational outcomes for children, and higher levels of civic engagement. Studies from the Pew Research Center show homeowners are 28% more likely to be involved in local organizations and 15% more likely to vote in local elections.

Freedom and Personalization

Owning a home provides the freedom to customize and modify your living space without landlord restrictions. This autonomy adds significant quality-of-life value that's difficult to quantify but remains a primary motivation for many homebuyers.

When Renting Might Make More Sense

Despite the advantages of homeownership, renting remains the better option in certain scenarios:

- Short-term residency (less than 3-5 years in one location)

- Career uncertainty or high mobility requirements

- In extremely high-cost markets with poor price-to-rent ratios

- When lacking sufficient savings for a down payment and emergency fund

Strategies for Prospective Homebuyers

For those considering homeownership in today's market:

- Take advantage of first-time homebuyer programs. Many states offer down payment assistance that can significantly reduce initial costs. The Federal Housing Administration (FHA) offers loans with down payments as low as 3.5%.

- Consider buying in emerging neighborhoods with growth potential rather than established high-cost areas.

- Explore house-hacking strategies (such as purchasing a duplex and renting one unit) to offset mortgage costs.

- Look into 15-year mortgages if affordable; they build equity faster and save tens of thousands in interest.

Conclusion

While the decision between buying and renting should always be tailored to individual circumstances, the data continues to support homeownership as the superior long-term financial strategy for most Americans. Despite market challenges, the combination of equity building, tax advantages, and protection against rent inflation makes buying a home an investment not just in property, but in financial security.

The path to homeownership may require patience and strategic planning in today's market, but the long-term benefits make it a goal worth pursuing for those seeking both financial stability and a place to call their own.

Continue Reading

Discover more financial insights and tips

The Debt Trap No One Talks About

Minimum payments are designed to keep you in debt longer, maximizing profits for credit card companies while minimizing your financial progress. Let's explore the true cost of this common practice and how it impacts your long-term financial health.

Frank DiGiacomo

Navigating the Checkout: "Buy Now, Pay Later" vs. Traditional Credit Cards

Explore the dynamic world of financial flexibility with our latest infographic, where we visually compare the modern convenience of "Buy Now, Pay Later" services against the traditional benefits of credit cards. Dive into an intuitive portrayal of how each option fits into the cyclical nature of spending and payments, symbolized by a credit card's journey around the clock.

Frank DiGiacomo